Fifteen years ago, nearly every PowerPoint presentation about wireless had a slide predicting data traffic taking off like a hockey stick. What might have seemed overly optimistic then looks like an underestimation now.

That’s one takeaway from Cisco’s latest Visual Networking Index Global Mobile Data Traffic Forecast (2015 to 2020), which cites Maravedis’ Wi-Fi research. According to Cisco:

- Monthly mobile data usage in 2015 hit 3.7 exabytes and is track to reach 30.6 exabytes by 2020. That means 2020 traffic will be 120 times greater than in 2010.

- Between 2015 and 2020, global mobile data traffic will grow twice as fast as fixed IP network loads.

- In 2015, 51 percent of mobile data traffic was offloaded to Wi-Fi. By 2020, Wi-Fi’s share will grow to 55 percent.

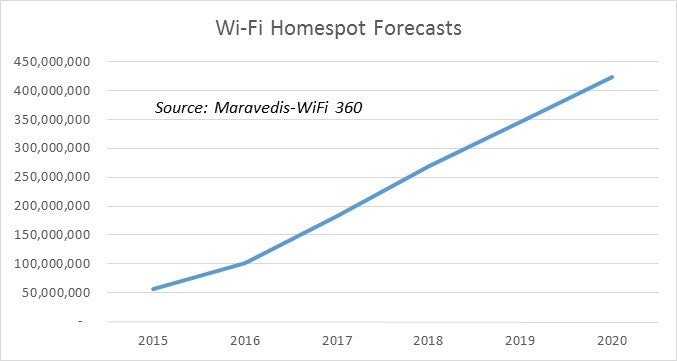

- In 2015, there were 64 million Wi-Fi hotspots worldwide, including 57 million home spots, based on Maravedis’ research. By 2020, they’ll hit 432 million, of which 423 million will be home spots.

Although consumer and business applications such as video are responsible for a lot of that traffic, Cisco expects Machine to Machine/Internet of Things (M2M/IoT) applications to account for a big chunk of growth:

- Nearly 8 percent of mobile connections in 2015 were IoT. By 2020, they’ll be 26.4 percent.

- In 2020, those devices will generate 6.7 percent of all mobile traffic versus 2.7 percent in 2015.

- One type of IoT device – wearables such as smart watches – will grow six-fold from nearly 97 million in 2015 to more than 600 million in 2020.

To maximize their share of the M2M/IoT market – and the revenue that comes with it – mobile operators will need to adopt a host of emerging low-power wide-area (LPWA) cellular technologies: LoRa, Random Phase Multiple Access (RPMA), Ultra Narrow Band (UNB), Extended Coverage GSM (EC-GSM), LTE Machine Type (LTE-M) and the LTE-based Narrow Band (NB) IoT.

These proprietary and standards-based LPWA technologies will help cellular meet IoT’s price and cost requirements, which are significantly lower than those of smartphones and tablets. Without them, cellular will lose IoT market share to Wi-Fi, partly because its chipsets are so inexpensive and partly because its indoor coverage often is superior to cellular’s.

The Wi-Fi community also isn’t resting on its laurels. For example, earlier this year, the Wi-Fi Alliance launched HaLow, formerly known as 802.11ah, which uses the 900 MHz band to provide better indoor coverage. Maravedis believes that HaLow is potentially a very disruptive technology, especially with the arrival of tri-band routers that support 2.4GHz, 5.8GHz and the 900 MHz used by 802.11ah. For instance, a residential tri-band router could take traffic to and from consumer-oriented IoT devices and the home’s smart utility meter backhaul and run it over that customer’s wired broadband service. That scenario completely cuts the mobile operator out of the picture. Similar scenarios could play out in the enterprise market, too, further cutting into mobile operator revenue from IoT.

Of course, many mobile operators already own wide-area Wi-Fi networks and/or partner with Wi-Fi aggregators such as Boingo. These initiatives help mobile operators both enable and leverage the offload trend that Cisco’s VNI quantifies. Today, as much as 70 percent of international travelers often rely on Wi-Fi instead of cellular, according to the WBA’s recent “Wi-Fi Roaming Business Case” report. As the Wi-Fi community makes it easier for travelers and other people to roam on Wi-Fi, it’s not hard to see why Cisco’s 2020 forecast of 55 percent offload could be on the mark.

The bottom line is that there are plenty of business opportunities as consumers and business users increasingly shift their voice, video and data from fixed networks to wireless ones. Those opportunities also will drive cellular and Wi-Fi to both compete and cooperate.